How to look up a charity’s T3010

What if you drove by Smalltown Community Church and wanted to know what that church did with donations? If the (Canadian)* church is a registered charity, this information is available online. Answer to questions like:

How much money did the church receipt last year?

How much did the church pay staff?

Which charities did the church contribute to?

The last question is my personal favourite. The list of charitable donnees is fascinating. How much did the church forward to its denomination (if applicable)? What local charities does the church support? Multiple years of the T3010 report are posted, so you can see trends. You’ve probably gathered by now that I look up T3010s quite often.

Accessing T3010 information online

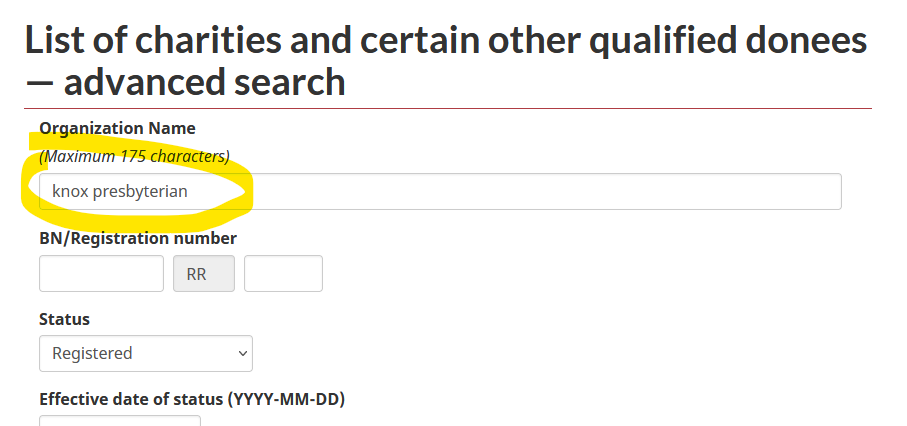

In Canada, charities must complete this T3010 form every year. It’s publicly available information on how much money the charity received in donations and what they did with that money. Here’s the link to the advanced search. You don’t need to fill out all the fields, but if you’re looking for Knox Presbyterian or First Baptist, it’s useful to be able to specify which city! For this example, I’m going to use Knox Presbyterian.

The database will bring up a list of all the charities with that name, in this case all 108 Knox Presbyterians. Many churches in Canada have the 1967 date, that refers to registration and not the founding of the church. (1967 was also the last year the Toronto Maple Leafs won the Stanley Cup, but this is a coincidence!)

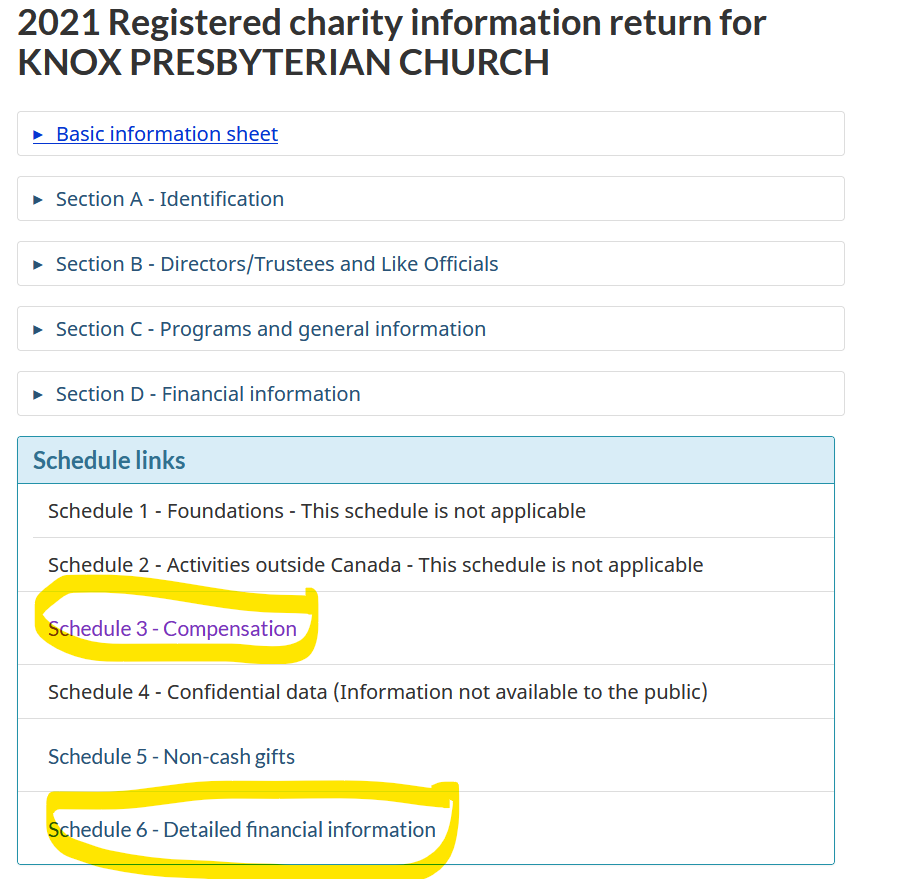

Click on the Organization name in the left column. The next screen will include many options for looking at the data. I like looking at the full view, choose 2021-12-31. The exact dates will vary depending on whether the church uses the calendar year as its fiscal year.

The information is divided into sections and schedules. Section D is the financial information. Schedule 3 will provide an overview of staff compensation, looking at number of staff by pay grade rather than individually. Schedule 6 provides detailed financial information, as promised.

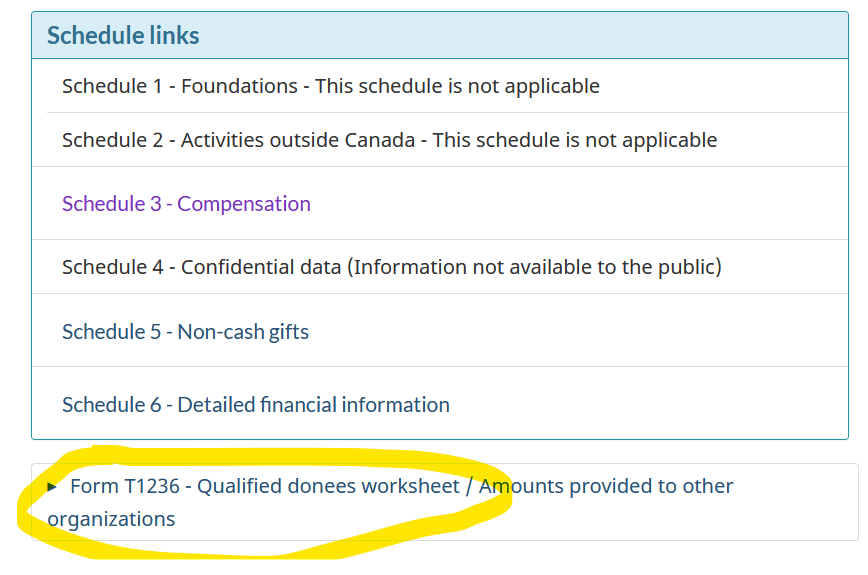

Underneath the schedule links, there is a mysterious item called Form T1236 - Qualified donees worksheet. This is well worth exploring, it’s a list of amounts given to other charities i.e. how much did the church give the denomination, the food bank etc.

There you have it, a quick guide to looking up a charity’s T3010 (remember, in Canada a church is usually a charity.) I’ve explained this process to seminary students, denominational staff and now to you, gentle reader.

Numbers can’t tell the full story of a church, but they do provide an interesting snapshot of how a church uses it money. I hope this information is useful to you.

*American readers: Lake Institute Research on Faith & Giving is a great resource. You can’t look up charities by name though, the US regulatory environment is quite different.